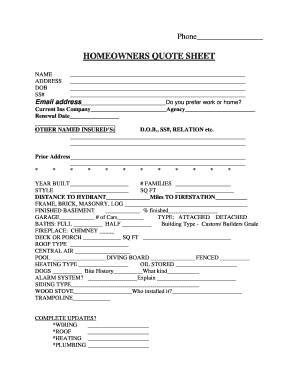

MN Homeowners Insurance Quote Form free printable template

Show details

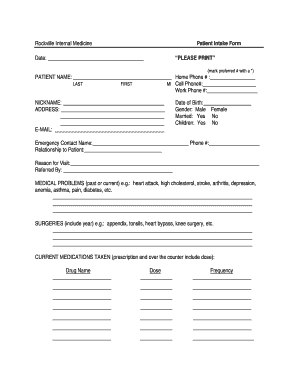

Homeowners Insurance Quote Form Personal Information: 1st Named Insured Home Phone: 2nd Named Insured: Home Phone: Mailing Address: Date of Birth: Cell Phone: Date of Birth: Cell Phone: Township:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign homeowners insurance quote form

Edit your auto insurance quote form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance quote form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurance quote request form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insurance claim processing quotation form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hoi quote form

How to fill out MN Homeowners Insurance Quote Form

01

Begin by gathering personal information, including your name, address, and contact details.

02

Provide information about the property you wish to insure, including its age, type, and square footage.

03

List any safety features of the home, such as smoke detectors, security systems, or fire extinguishers.

04

Describe the contents you want to insure, including valuable items like electronics and jewelry.

05

Indicate any previous insurance history or claims you have made.

06

Review available coverage options and select the coverage limits that meet your needs.

07

Complete any additional questions regarding liability coverage and deductibles.

08

Submit the completed form, ensuring all information is accurate.

Who needs MN Homeowners Insurance Quote Form?

01

Homeowners looking to protect their property and personal belongings.

02

Individuals purchasing a new home who require insurance.

03

Current homeowners seeking to compare insurance rates and coverage options.

04

Landlords insuring rental properties.

Fill

home owners insurance quote

: Try Risk Free

People Also Ask about homeowner insurance quote sheet

What does quotation look like?

The use of quotation marks, also called inverted commas, is very slightly complicated by the fact that there are two types: single quotes (` ') and double quotes (" ").

What is quotation example?

Use quotation marks if the word or words are meant to imply irony or sarcasm. Example: The mayor told the people of his town that he “cares” about their well-being. • Use quotation marks to highlight certain words within a sentence. Example: I wrote “your” when I meant to write “you‟re.”

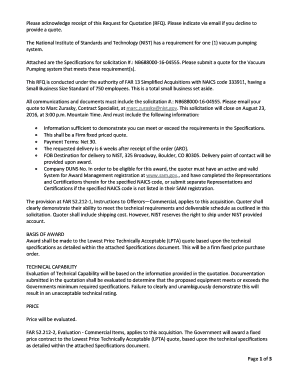

What are the steps of quotation?

The specific steps of a quoting process are: acknowledgment of the quote request, creation and internal approval of the quote, the customer's acceptance, and the quote converted to an order or contract.

How do you fill out a quote form?

How to write a quote? Choose a professional quote template. Enter your quote number. Add customer information. Add product or service descriptions. Add your business and contact information. Include the issue date. Specify the terms and conditions of your quote. Include notes and/or additional details.

What is an example of quotation and definition?

quotation noun [C] (SAID) a phrase or short piece of writing taken from a longer work of literature, poetry, etc. or what someone else has said: At the beginning of the book there's a quotation from Abraham Lincoln. Fewer examples. Her speech was larded with literary quotations.

How do they write a quotation?

How to create a quote for a client in 8 easy steps Choose a professional quote template. Enter your quote number. Add your customer information. Add your business and contact information. Add the date of issue. Enter an itemized list of your products and/or services. Specify your quote terms and conditions.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit insurance quote request form template online?

With pdfFiller, it's easy to make changes. Open your auto insurance quote sheet in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit home insurance quotation form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share homeowners insurance quote sheet template on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out home insurance quote form template on an Android device?

Use the pdfFiller app for Android to finish your homeowner quote sheet. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is MN Homeowners Insurance Quote Form?

The MN Homeowners Insurance Quote Form is a document used by homeowners in Minnesota to obtain an estimate of insurance premiums for coverage on their property. It includes details about the home and desired coverage levels.

Who is required to file MN Homeowners Insurance Quote Form?

Homeowners or renters in Minnesota looking to purchase homeowners insurance coverage are required to fill out the MN Homeowners Insurance Quote Form to get premium estimates from insurance providers.

How to fill out MN Homeowners Insurance Quote Form?

To fill out the MN Homeowners Insurance Quote Form, provide accurate details about the property, including the address, square footage, age, construction type, and any safety features. Additionally, indicate the desired coverage amounts and any specific insurance needs.

What is the purpose of MN Homeowners Insurance Quote Form?

The purpose of the MN Homeowners Insurance Quote Form is to allow homeowners to compare insurance policies and premiums offered by different insurers, helping them make informed decisions about their home insurance.

What information must be reported on MN Homeowners Insurance Quote Form?

The MN Homeowners Insurance Quote Form typically requires information such as the homeowner's personal details, property address, property description, value of personal property, security features, prior insurance claims, and any additional coverage options desired.

Fill out your MN Homeowners Insurance Quote Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homeowners Insurance Quote Sheet is not the form you're looking for?Search for another form here.

Keywords relevant to auto insurance quote sheet template

Related to homeowners quoting sheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.